About Chartered Accountancy (CA )

Chartered accountant designation is worldwide, and it refers to professional accountants who are qualified to take on a number of specific activities within the spectrum of accountancy. Such tasks include auditing financial statements, filing of corporate tax returns, and financial advising. While the name is seen around the globe, in the United States, the equivalent position is known as a certified public accountant, or CPA. The professional body that governs this group of accounting workers goes back to 1854 where it was founded in Britain. There are now several associations that act as governing and accrediting bodies for these professionals, such as the Canadian Institute of Chartered Accountants and the Institute of Chartered Accountants in England and Wales.

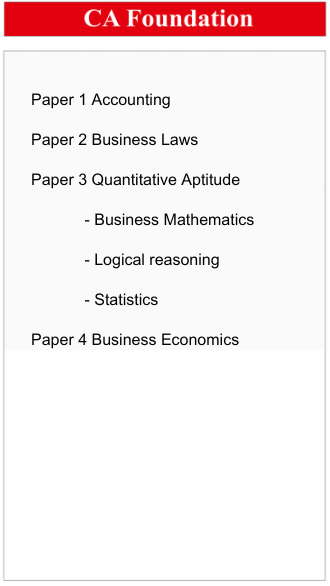

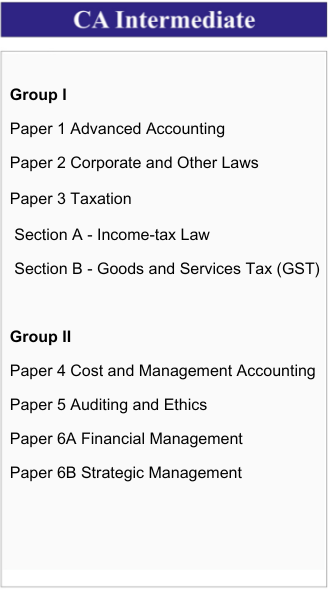

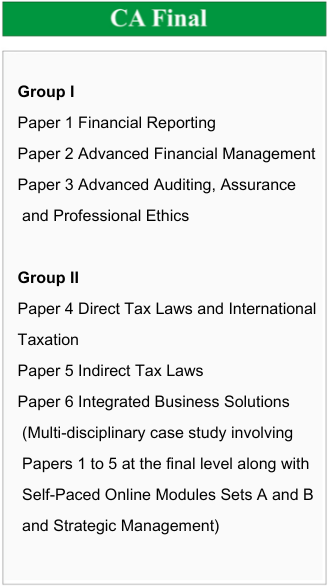

Syllabus for CA Exams

CA New Scheme Important Update

The ICAI has launched the CA New scheme on July 1, 2023, and it will be applicable from the May 2024 exams. We suggest all the CA students whose papers are scheduled for May 2024 attempt to plan their studies accordingly.

Important Dates

ICAI provides the Important dates regarding the CA New Scheme in the recent announcement as follows:

| Particulars | Date/Attempt |

| Last date for Registration in Foundation under Existing Scheme | 1st July 2023 |

| Last date for Registration in Intermediate and Final Courses under Existing Scheme | 30th June, 2023 |

| Date of commencement of Registration and Conversion in Foundation Course under New Scheme | 2nd August, 2023 |

| Date of commencement of Registration and Conversion in Intermediate and Final Courses under New Scheme | 1st July, 2023 |

| First Foundation Examination under New Scheme | June, 2024 |

| First Intermediate and Final Examination under New Scheme | May, 2024 |

| Last Foundation Examination under Existing Scheme | December, 2023 |

| Last Intermediate and Final Examination under Existing Scheme | November, 2023 |

| Last date of commencement of three years of Practical Training | 30th June, 2023 |

| Date of commencement of two years uninterrupted Practical Training | 1st July, 2023 |

CA Foundation Fee

Projects

REGULAR BATCH

₹25000/-

COMPLETE SYLLABUS

(+GST@18%)

Mock Tests, Study Notes, Online/Offline Live Classes, Small Batches, Practice Sessions, Demo Classes

INDIVIDUAL CLASSES

₹40000/-

COMPLETE SYLLABUS

(+GST@18%)

Mock Tests,Study Notes, Online/Offline Live Classes, Small Batches, Practice Sessions, Demo Classes

PAPER-WISE CLASSES

₹15000/-

PER SUBJECT

(+GST@18%)

Mock Tests, Study Notes, Online/Offline Live Classes, Small Batches, Practice Sessions, Demo Classes

NOTE: GST applicable on fees

CA Inter Fee

Projects

REGULAR BATCH

₹45000/-

PER GROUP

(+GST@18%)

Mock Tests, Study Notes, Online/Offline Live Classes, Small Batches, Practice Sessions, Demo Classes

INDIVIDUAL CLASSES

₹70000/-

PER GROUP

(+GST@18%)

Mock Tests, Study Notes, Online/Offline Live Classes, Small Batches, Practice Sessions, Demo Classes

PAPER-WISE CLASSES

₹20000/-

PER SUBJECT

(+GST@18%)

Mock Tests, Study Notes, Online/Offline Live Classes, Small Batches, Practice Sessions, Demo Classes

NOTE: GST applicable on fees

Entry Route to CA Course

Foundation course route (after 10+2 Examination)

Step-by-Step Approach to all the Courses and Exams Step 1: Enroll yourself in the CA Foundation Course after completing XIIth. Step 2: Complete a 4-month study period and appear in the CA Foundation Examination. Step 3: Enroll into CA Intermediate Course after clearing CA Foundation Exam. Step 4: Complete 4 weeks of Integrated Course on Information Technology and Soft skills (ICITSS). This course needs to be completed before your articleship. Step 5: Complete 8 months study course of CA Intermediate and appear for the exam. There will be 2 groups of exams, you need to pass at least one before moving forward. Step 6: Join 3-year article training after passing either group of CA Intermediate Exam and complete ICITSS before starting your articleship. Step 7: Clear the remaining group of CA Intermediate Exam (if there’s any). Step 8: Enroll yourself for the CA Final Course. Step 9: Complete 4 weeks of Advanced Integrated Course on Information Technology and Soft skills (AICITSS) in the last two years of your articleship and before appearing for the final exam. Step 10: Appear for the final exam either after completing your articleship or during the last 6 months of it. Step 11: Complete your article training, in case you decide to appear for the final exam while serving your articleship. Step 12: Clear the CA Final Examination. Step 13: Enroll yourself as a member of the ICAI to be designated as a “Chartered Accountant”. |

| Direct entry route (after graduation or post-graduation)

Chartered accountant after completing your graduation or post-graduation, if you have scored at least 55% aggregate in your commerce graduation/post-graduation, or at least 60% if you are not a commerce graduate/post-graduate. Step by step process Step 1: Enroll into CA Intermediate Course. Step 2: Complete 4 weeks of Integrated Course on Information Technology and Soft skills (ICITSS). This course needs to be completed before your articleship. Step 3: Register for 3-year articleship or practical training. Step 4: Appear for the CA Intermediate Examination after 9 months of your training. Step 5: Clear both groups of CA Intermediate Examination. Step 6: Register for CA Final Course. Step 7: Complete 4 weeks of Advanced Integrated Course on Information Technology and Soft skills (AICITSS) in the last two years of your articleship and before appearing for the final exam. Step 8: Appear for the final exam either after completing your articleship or in the last 6 months of it. Step 9: Complete your 3-year training. Step 10: Clear the CA Final Examination. Step 11: Enroll yourself as a member of the ICAI to be designated as a “Chartered Accountant”. |

Registration for CA Foundation

Follow these steps to register:

- Log on to the ICAI’s official website

- Now, fill in the required details like name, date of birth, Aadhar number, email, mobile number, and create a password.

- Once the account is created, log in to the registration portal

- Enter the mandatory details

- Select the list of documents as per your qualification and preference from the following

options:

Passport Size Photograph

Signature

Birth certificate (10th pass certificate)

Roll number (if appearing)

12th passing certificate/mark sheet

Category Certificate (if you belong to SC/ST or Physically Handicapped Category)

- Upload the requisite documents

- Make the payment online

- Save the document and print it

- Sign and attest the application form

- Send the application to ICAI

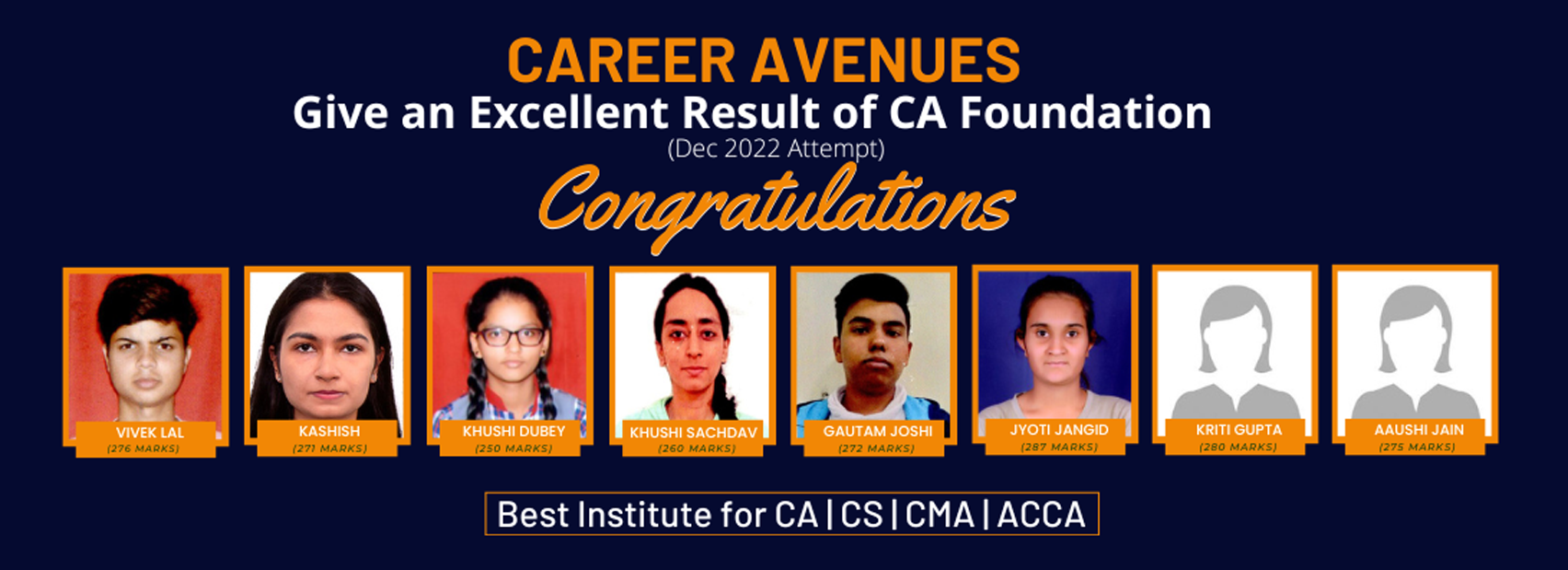

Why Career Avenues for CA

- 18+ years of excellence in providing world class education.

- Achieved the milestone of training over 1,00,00+ students.

- Career Avenues, the best CA, CS and CMA coaching in Green Park.

- The most experienced faculties.

- Excellent Results in CA , CS and CMA Exams.

- Small Batches are Available.

- Holistic teaching methodology covering all aspects of CA, CS and CMA preparation.

- Our faculty has always been our greatest strength.

- Our faculty does not only believe in theoretical knowledge but also teaches their students to use their knowledge practically.

- Our coaching helps students acquire knowledge that they need to succeed and sustain the difficulties they might face